Commentary from Clean EDGE Asia

Bidding for Bangladesh

The Suitability of Auctions for Renewable Energy

S.M. Zahid Hasan examines the causes and gaps of standardized auction initiation in Bangladesh in terms of institutional framework conditions, variable renewable energy market analysis, and capacity needs. He also considers suitable market mechanisms for successful auctions, insights for investors, and ideas for incentives that can be shared in similar emerging economies.

With its holistic approach to protecting the environment, circular energy has greatly contributed to the total energy generation capacity and sustainable development goals in several countries. As an emerging economy, Bangladesh is different, with only 4% of its total energy generation capacity coming from clean energy. While the EU and U.S. markets are dominated by private power producers, with 75% and 80% market shares, respectively, only 46% of Bangladesh’s power is produced by private entities.[1] Through costly procurement rewards, the country has 912 megawatts (MW) of installed renewable energy (RE) generation capacity, including 678 MW from solar,[2] and is projected to reach 4,100 MW capacity by 2030.[3] The award per kilowatt-hour (kWh) for solar grid–connected photovoltaic (PV) energy is currently around $0.08, compared with $0.03 per kWh in India.[4] The government’s Mujib Climate Prosperity Plan Decade 2030 targets 40% of generation from RE—including nuclear power and imported clean power—by 2041.

Overall, Bangladesh has achieved around 29,727 MW of installed power capacity. At present, the country faces around 1,533 MW in forced load shedding for primary fuel price hikes against a maximum demand and generation of 17,200 and 16,477 MW, respectively. In its Power System Master Plan 2016, the government pledges to increase power generation to 40,000 MW by 2030, and under the Integrated Energy and Power Master Plan 2023 the total installed capacity needs to rise to 74.3 gigawatts (GW) by 2041, which requires a huge investment.[5] At present, around 10,000 MW of capacity in RE power projects is awarded to independent power producers (IPPs), with 906 MW and 2,000 MW in the planning and bidding stages for the public and private sectors, respectively. However, the implementation rate is much slower (accounting received only 26% of awarded contracts until 2023, with a capacity of 459 MW).[6]

As the reverse auction mechanism is very flexible and can be optimized in different ways, the number of countries using reverse auctions for renewables has increased to 131.[7] A reverse auction is a procurement method of goods and services in which the traditional roles of buyer and seller are reversed. Auctions can be held as sealed bids, ascending or descending clock bids, or multi-item bids. In a sealed-bid auction, the process can be either a priced bid or pay as you bid, allowing multiple units of the same product with different prices to go to more than one project developer. The sealed-bid auction is simple and easy to implement, fosters competition, and avoids collusion. Descending clock bids use multiple rounds with greater transparency, where auctioneers progressively lower the price until the quantity offered fulfills the quantity needed. As well as price, a multi-criteria auction includes local content requirements or technology innovations. Other features can also be added to an auction, such as setting the price ceiling as a bid limit, a minimum or maximum project volume, or a bidder concentration rule to prevent large volumes from being allocated to only a few bidders.[8]

Though Bangladesh is among the countries using auctions, it has not yet initiated an auction for RE following standard auction formats to improve competition, influence private companies, or level the playing field. This essay examines the causes and gaps of standardized auction initiation in Bangladesh in terms of institutional framework conditions, variable RE (VRE) market analysis, and capacity needs. It also considers suitable market mechanisms for successful auctions, insights for investors, and ideas for incentives that can be shared in similar emerging economies.

Renewable Energy Projects in Bangladesh

One of Bangladesh’s sustainable development goals is to substantially increase the share of RE in its energy mix. The government set out and failed to hit a target of 5% installed power from RE by 2015, a goal supplanted by an objective to hit 10% by 2025. Utility-scale VRE procurement has been done primarily through unsolicited offers and on a negotiation basis. The single buyer, the Bangladesh Power Development Board (BPDB), launched an auction for a 258 MW PV project at an average price of $136 per megawatt-hour (MWh) in March 2017 on land it provided and within a grid integration location it specified. Another solar project of 200 MW on a build-own-operate (BOO) basis passed through an auction to develop four power plants, though one was ultimately canceled.[9] For BOO projects, the BPDB only facilitates initial land acquisition.

Since Bangladesh’s energy market uses premature market mechanisms without an institutional framework specifically for RE auctions, the price of awarded contracts is higher than it should be. During the contracting process, approval and financial closing of the projects have taken a considerably long time. Presently, eleven grid-connected solar-power plants with a total capacity of 703 MW are running with an average actual power generation of around 270 MW.[10] However, a 60 MW wind power project at Khurushkul shows reliable output.[11]

How Renewable Energy Auctions Can Help with the Clean Energy Transition

In an auction, the buyer seeks a price proposal for a required good or service at a competitive market price. As the sellers compete to obtain business from the buyer, prices will typically decrease as they underbid each other. To avoid discontinuous market development, an auction needs to be held in a narrow time frame in a comparatively straightforward way.

For RE projects, auctions are also known as “demand auctions” or “procurement auctions.” They can be implemented in monopolistic conditions as well as in liberalized markets. If properly designed, auctions introduce checks and balances in terms of bidders’ confidence, capacity assessments of the grid, proper package (volume) design, proper location-based resource mapping, capacity building of pertinent stakeholders (without compromising standards), and socioeconomic and environmental interest. Theoretically, an auction can be used to determine the feed-in tariff (FIT) and can be combined with a feed-in premium (FIP). Auctions are the best practice to encourage fierce price competition and historically low electricity tariffs while promoting private investment around the globe for sustainable development gains.[12] From 2010 to 2018, the average global prices for auctions of solar PV decreased by 77% and onshore wind prices by 36%.[13] Auctions are viable in all markets, regardless of development level or market maturity, as policymakers can tailor and choose the best entities to conduct them.[14]

Case Studies

India. In India, fierce price competition in auctions forces project developers to close their bids to their expected electricity costs per kWh. India alone achieved 17 GW of solar PV capacity at an average price of $42.3/MWh. A study conducted in India found that “about two thirds of the auctions were limited to domestic players (including foreign firms with subsidiaries in India), while one third of the auctions were open to global competition (foreign firms need to set up an Indian company in case they win the auction).” It also found that “about 60% of the auctions were BOO with an associated PPA while 40% were EPC [engineering, procurement, and construction] plus O&M [operations and management] arrangements for at least two and up to 35 years.”[15]

India’s average BOO project size is 10 times the EPC project size, and EPC auctions increase the number of international quality standards by an estimated 54.7% over BOO auctions. By contrast, for a principal-agent (IPP) model in India, EPCs have no (economic) incentive to focus on quality beyond their O&M period. Whereas in a BOO contract, remuneration is fully performance-based and the owner has a strong incentive to maximize the output over the lifetime of the plant, it may take several years to amortize costs and generate profits in an IPP model. The IPP model uses upfront payments, sanctions, and performance targets to monitor and guarantee that the power producers do not simply neglect their contractual obligations.

India’s initiative for solar parks, which is primarily intended to address land and power evacuation infrastructure critically, has been established for large-scale solar PV projects. Local content requirements were introduced in India’s public auctions for solar PV plants that obligate IPPs and project developers to source solar PV modules or cells in India. The rationale for local content requirements in this case is that local producers are temporarily protected from foreign competition and can gain hands-on experience with a certain technology.[16] A unique element in India’s auctions is that payment for electricity generated through the solar plant is bundled with cheaper thermal power to keep retail prices manageable.[17] On the other hand, in July 2018 the imposition of a 25% safeguard duty, coupled with volatility in the Indian rupee, deepened developers’ uncertainty toward the solar parks. Trade-offs between achieving socioeconomic objectives and procuring electricity at low prices cannot be avoided.

China. In China, technology-focused auctions are often held specifically for solar and wind to build up local RE industries. Their auctions sometimes coexist with FIT. In 2020, solar PV auction volume in China was 25.6 GW.[19] In 2018, 5 GW in solar PV contracts were awarded at an average price of $64.6/MWh, which was 48% lower than the average price of $123.65/MWh in the seventeen auctions conducted in 2016. This happened due to conducive land-use policies for renewables, competitive interest rates on loans (around 4.4%–4.9%), and government commitments to low curtailment (less than 5%). The land rental price in predetermined areas for auctioned projects was 80%–90% cheaper than in other locations.[20]

The Suitability of Auctions for Variable Renewable Energy in Bangladesh

In Bangladesh, RE auctions are advancing on an ad hoc basis, and project-based and price-based strategies are dominant. Considering the smaller volumes auctioned, the stringency of technical requirements and qualification criteria for the bidders are more lenient (at least one previous project of a minimum 5 MW capacity using the same technology in operation for at least two years).[21] The present strategy of cheaper tariff-based power at government-specified locations or bidder-preferred sites with minimal requirements in BOO auctions represents a strategic political choice since the transfer of risks to project developers benefits the public budget. The present scenario may have a few unintended and negative consequences, such as fierce price competition from cheap, imported RE technology components, which erode profits, and a lack of local industrial learning. On the other hand, in India a gradual increase in the stringency of technical requirements and local content requirements in EPC auctions illustrates that auctioneers and local manufacturers can accrue technical expertise. A common criticism of local content requirements is that they often fail to transform nascent industries into competitive ones by neglecting to provide sufficient incentives for local beneficiaries to improve performance and reduce prices because of rent-seeking and government failure.[22]

It is unlikely that project developers will invest in research, development, and quality upgrading. Therefore, high-end companies are more likely to either exit the market or lower the quality and costs of their project components. As a result, the ultimate project costs may be higher because of major or auxiliary failures, with the generated output lower than expected. Therefore, banks and investors remain reluctant to finance such projects due to technological risk. Moreover, social trust and general perceptions play an important role in the dissemination of a technology. The unreliable wind power output of some pilot projects in Bangladesh has created uncertainty and a public loss of confidence in RE. More stringent technical requirements, proactive approaches to adopting international quality standards (like those of the International Electrotechnical Commission), and the establishment of testing facilities to attract investors with a longer time horizon may be an alternative solution.[23]

In principle, a VRE auction combined with a sliding FIP reduces the risk of overcompensation. Moreover, as per the auction experience, the FIP model performs best in a market where energy storage and the scheduling of the production facility are possible (e.g., converting wind or solar to hydrogen). For a fixed FIP, project developers can enjoy high rewards when market prices increase, but they also run a corresponding risk when prices decrease. Therefore, in order to avoid a large divergence between profits and losses, projects can be designed with payment caps and floors.[24]

Challenges. Risks still constitute a major barrier in many parts of the world for conducting auctions. These may include political and regulatory limitations; limitations related to counterparties, grids, and transmission; and limitations related to currency, inflation, liquidity, and refinancing. Moreover, auctions do not give equal opportunity to new players, and the process overemphasizes price as a buying criterion. Auction tariffs can only work when the distribution company is able to guarantee the payments. Low winning bids can turn into a curse if overly optimistic project developers build their projects using low-quality components, underestimate operations and maintenance costs, or expect low interest rates and stable currency exchange rates.[25] A major challenge for RE deployment is aligning it with other policies and socioeconomic goals. The failure to exploit synergies between the energy sector and the broader economy can mean a lost opportunity to maximize the benefits of the energy transition. Properly estimating the auctioned volume of maximum capacity that the existing system can accommodate is also a challenge.[26]

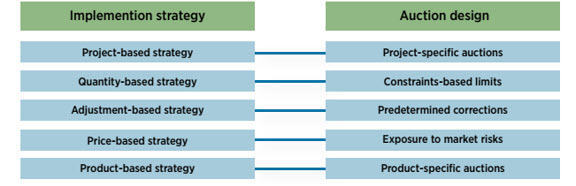

Implementation strategies. Auction strategies can be project-based, quantity-based, adjustment-based, price-based, or product-based. Project-based strategies can be implemented through a project-specific auction with energy producers and provide low market access risk and suitability in power systems based on a single-buyer model. They rely on the existence of a mature market and the capability of providing cost-reflective and non-distortive price signals. Quantity-based strategies are more flexible than project-based ones but have important system constraints (e.g., location or technology) to ensure smooth operation. Adjustment-based strategies rely strongly on a system operator’s ability to forecast how system needs will evolve in order to yield the most desirable outcome. Price-based strategies assign the responsibility of matching generation rates to system needs and exposing market prices and risks to developers, obliging them to rely on their own market knowledge. Finally, product-based strategies involve focusing on power market products (e.g., energy, capacity, systems, or services) rather than on the technologies used to produce them.

Figure 1: Implementation strategies for auction design to support increasing shares of VRE[27]

Reverse auctions: Essence, principle, and design. Auctions are artificially created markets in which actors operate under predefined rules and decide if they interact with each other depending on game theory.[28] Correctly setting the incentive structure and rules is part of the art of auction design. For a successful RE auction, easy access to information, proper knowledge of project economics, a perception of process fairness, and management of default risks are preconditions.

Designing auctions in line with a country’s institutions and industries is crucial. Auction design should emphasize limiting various risks associated with bid security and liquidity damages, as well as the cost of capital (risk premium). The process requires healthy participation from project developers that will enable the environment, impose fewer transaction costs, and limit risks, thereby decreasing the likelihood of a “winner’s curse.”[29] Additionally, the project’s realization period, incentives, and institutional arrangements need to be specified. Overly stringent quality standards can force nascent players to exit the market. In the auction process, the most important components are the auction format, the criteria that determine ranking, pricing rules, the existence of maximum and minimum prices, discriminatory factors, and the frequency of auction rounds. An auction must strike the right balance between prequalification requirements and financial guarantees.[30] When done properly, it can promote community participation and social acceptance, improve regional development, and enhance the equity and inclusiveness of the low-carbon energy transition.

RE auction platforms. Auctions can be either paper-based or web-based to ensure transparency, efficiency, and scalability. In web-based auctions, bidders submit their proposals to a dedicated virtual platform where digitalized actions are implemented in static or dynamic processes. This helps the auctioning authority gather and evaluate more bids and eases the participation of international bidders. Web-based auctions are practiced in Kazakhstan, the Philippines, and Mexico.

Options for Policymakers in Bangladesh

AVRE project mapping. As VRE projects are location-constrained, their success largely depends on proper planning and design, the choice of technology, and a location with abundant resources. Hotspots with a high potential for renewable resources are usually far from demand centers. Therefore, grid connectivity points, evacuation means, availability of land, and zone-specific capacity limits based on transmission constraints are important to achieving grid stability. The government can prepare a VRE map of future projects based on potential resources and feasibility studies to reduce the number of pertinent approvals required of project developers. Solar parks, as well as integrated and community-based approaches such as solar rooftops, are good examples. Mapping segmentation can be among zones or between small and large projects where the market is undistorted and protected by grid codes and anti-dumping measures.

Help desk for arrangement of pertinent permits. VRE projects usually face challenges of land acquisition, grid connectivity for power evacuation, environmental clearance, necessary permission, and contract management. Therefore, a one-stop help desk of auctioneers with the necessary services and accessible information can ease the process.

Auction packages and volume. Auctions can be combined with an FIP, bundled with other plants, or folded. To achieve predefined environmental targets and avoid intermittent episodes of limited deployment, auctions should be held at regular intervals, at least once per year. Regarding volume, the auctioning mechanism should require that at least two bids be received for each demand tranche before the capacity can be awarded, and the total volume of bids received should amount to at least 150% of the total volume auctioned.

Defining favorable time frame and qualification criteria. Defining a favorable time frame for bid preparation, processing, evaluation, and awarding can improve the quality of auction events by avoiding procrastination. To avoid underbidding, a diversified pool of players and post-qualification requirements for project developers can be introduced. In Bangladesh, where the market is immature, it is preferable to follow a pay-as-you-bid pricing rule rather than uniform pricing, which typically leads to underbidding. This pricing rule is easily understood by bidders and incentivizes them to place bids above their true cost. Moreover, to increase competition, the auctioneer can split bid security and performance security to create a user-friendly atmosphere. Furthermore, policymakers could include criteria for minimum viability so as to prevent underbidding, which could be countered by setting stringent qualification criteria.

Building up confidence and gaining social trust through alignment with international standards. Increasing stakeholders’ confidence through capacity building and higher awareness is important for the success of an auctioned project. In this case, associated institutional setup and smooth coordination among all stakeholders play a vital role. Though floating solar technology is promising (being 10% more efficient than a land-based PV plant), the potential site at Kaptai Lake is mired by a prolonged decision-making process and faces challenges from the local community due to a lack of awareness and confidence. To overcome this, an awareness campaign and alignment with international standards could significantly boost the confidence levels of local inhabitants.

Tariff incentives, interest, and green financing. Present tax waiver policies for solar PV panels only apply to IPPs. Waivers for solar PV panels could be broadened to include public procurement as well. Because of a lack of private investment for small-scale VRE projects, the government can launch an auction in combination with a FIT for small VRE project schemes, like in Uganda, where a Global Energy Transfer FIT program can combine unit energy costs. Payment for premiums for the projected twenty years of useful output of the plant can be frontloaded during the first five years of critical operation to facilitate more funding for the project rather than for support mechanisms.[31] Only an auction at the same time for a comparatively large VRE project is advisable. The introduction of local content requirements in Bangladesh for VRE auction mechanisms can reduce the number of quality bidders, whereas subsidies can help increase the number of bidders. Therefore, the government should consider introducing preconditional subsidies to assess compliance with international quality standards as a mandatory requirement.[32] Because of exchange rate fluctuations, the project developer should receive payment that considers adaptive rates for foreign currency payments. The government can set attractive and favorable policies for clean energy financing exclusively for soft loan cases.

Conclusion

As Bangladesh depletes its natural gas and coal resources, its energy transition becomes more urgent. Imported liquefied natural gas and coal price hikes raise a big challenge for the energy and power sectors and indicate that Bangladesh needs to update operational and market patterns originally designed for the fossil fuel era. The choice of auction strategy and design in each case needs to reflect specific circumstances, such as the existing market structure; the level of sector development; technical, administrative, and political capabilities; socioeconomic factors; and deployment and development objectives using transparent auction management and relevant research and development. Balanced risk mitigation through auction design for VRE projects could be further explored in future project-specific studies. The government can test a project-based pilot auction scheme in standard auction formats through the Bangladesh Power Development Board to determine the suitability of various power systems.

S.M. Zahid Hasan is Deputy Director at the Bangladesh Power Development Board, with a wide range of experiences as an expert in planning, designing, procurement, and implementation of energy and power facilities. He was a 2022-23 Clean EDGE Asia Fellow at the National Bureau of Asian Research.

Endnotes

[1] David Nelson et al., “Meeting India’s Renewable Energy Targets: The Financing Challenge,” Climate Policy Initiative, December 2012, https://climatepolicyinitiative.org/wp-content/uploads/2012/12/Meeting-Indias-Renewable-Targets-The-Financing-Challenge.pdf; and “Power Sector Dominates Power Generation with 54.35 Contribution,” Dhaka Tribune, December 1, 2018, https://www.dhakatribune.com/bangladesh/power-energy/162297/private-sector-dominates-power-generation-with.

[2] Sustainable and Renewable Energy Development Authority (Bangladesh), https://www.sreda.gov.bd.

[3] Mahmudul Hasan and Asifur Rahman, “Target to Generate 4,100MW by 2030,” Daily Star, October 31, 2021, https://www.thedailystar.net/business/economy/news/target-generate-4100mw-2030-2210291.

[4] Bangladesh Power Development Board, https://www.bpdb.gov.bd.

[5] Ministry of Power, Energy and Mineral Resources (Bangladesh), “Power System Master Plan 2016,” September 2016, https://powerdivision.gov.bd/site/page/f68eb32d-cc0b-483e-b047-13eb81da6820/Power-System-Master-Plan-2016; and Power Grid Company of Bangladesh Ltd, “Per Hour Generation and Load Shed,” https://erp.pgcb.gov.bd/w/generations/view_generations_bn?page=17.

[6] Bangladesh Power Development Board, “Monthly Progress Information of Power Sector,” December 10, 2023, https://bpdb.gov.bd/site/page/64a3fade-c8c4-4dc1-a76a-c42065a849d2/-.

[7] International Renewable Energy Agency (IRENA), Renewable Energy Auctions: Status and Trends beyond Price (Abu Dhabi: IRENA, 2019), https://irena.org/-/media/Files/IRENA/Agency/Publication/2019/Dec/IRENA_RE-Auctions_Status-and-trends_2019.pdf.

[8] Oliver Tietjen et al., “Renewable Energy Auctions. Goal Oriented Policy Design,” Deutsche Gesellschaft für Internationale Zusammenarbeit, February 2015, available at https://www.researchgate.net/publication/279183731_Renewable_energy_auctions_Goal-oriented_policy_design.

[9] Ivan Shumkov, “Bangladesh Approves 258 MW of New Solar Projects,” Renewables Now, March 2, 2017, https://renewablesnow.com/news/bangladesh-approves-258-mw-of-new-solar-projects-560134; IRENA, Renewable Energy Auctions; and Bangladesh Power Development Board, “Monthly Progress Information of Power Sector.”

[10] Bangladeh Power Development Board, “Daily Generation Report,” June 3, 2024, http://119.40.95.168/bpdb/daily_generation.

[10] Jobaer Chowdhury and Eyamin Sajid, “Country’s First Big Leap in Wind Energy from December,” Business Standard, July 21, 2022, https://www.tbsnews.net/bangladesh/energy/countrys-first-big-leap-wind-energy-december-462702.

[12] “ Global Trends in Renewable Energy Investment 2018,” United Nations Environment Programme, Frankfurt School of Finance and Management, and Bloomberg New Energy Finance, 2018, https://wedocs.unep.org/handle/20.500.11822/33382.

[13] Shumkov, “Bangladesh Approves 258 MW of New Solar Projects.”

[14] USAID, “Why Choose Renewable Energy Auctions?”

[15] Florian Anselm Münch and Adela Marian, “The Design of Technical Requirements in Public Solar Auctions: Evidence from India,” Renewable and Sustainable Energy Reviews 154 (2022): 5–6.

[17] Luiz Augusto Nobrega Barroso et al., “Performance of Renewable Energy Auctions: Experience in Brazil, China, and India,” World Bank, Policy Research Working Paper, no. 7062, 2014.

[18] IRENA, Renewable Energy Auctions.

[19] International Energy Agency, “China Competitive PV Auction Volumes, 2019 and 2020,” November 10, 2020, https://www.iea.org/data-and-statistics/charts/china-competitive-pv-auction-volumes-2019-and-2020.

[20] IRENA, Renewable Energy Auctions.

[22] Münch and Marian, “The Design of Technical Requirements in Public Solar Auctions.”

[24] IRENA, Renewable Energy Auctions.

[25] Münch and Marian, “The Design of Technical Requirements in Public Solar Auctions.”

[26] IRENA, Renewable Energy Auctions.

[28] Silvana Tiedemann, “Renewable Energy Auction Design,” Open Electricity Economics, http://www.open-electricity-economics.org/book/text/09.html.

[29] The term “winner’s curse” refers to the risks that some successful bidders face when they overestimate the value of an item or underestimate the cost of a project that ends up paying more for an item than it is worth.

[30] Tiedemann, “Renewable Energy Auction Design.”

[31] René Meyer, Bernard Tenenbaum, and Richard Hosier, “Promoting Solar Energy through Auctions: The Case of Uganda,” World Bank, Live Wire, November 24, 2015, available at https://openknowledge.worldbank.org/entities/publication/406210a3-2f77-5080-86c8-27b77f88687c/full.

[32] Münch and Marian, “The Design of Technical Requirements in Public Solar Auctions.”