Commentary from Clean EDGE Asia

The Potential of Hydrogen for Decarbonizing Iron and Steel Production in Vietnam

Nghiem Thi Ngoan highlights the potential of green hydrogen for decarbonizing iron and steel production in Vietnam and illustrates the potential to reduce carbon emissions through the use of green hydrogen as an alternative to coal.

Steel production currently accounts for 8% of total global CO2 emissions. Emissions from steel production must decrease for the industry to achieve net-zero emissions by 2050 and for countries to deliver on the commitments made in the Paris Agreement.[1] Between 2016 and 2020, the manufacturing sector made up 23.8% of Vietnam’s GDP,[2] with almost one-fifth—5% of the manufacturing sector—coming from the domestic iron and steel industries.[3] Surprisingly, the steel sector alone is responsible for 7% of Vietnam’s total CO2 emissions. Decreasing emissions from iron and steel will require transitioning away from fossil fuels that have traditionally powered production and shifting toward low or zero-emission alternatives.

This essay highlights the potential of green hydrogen for decarbonizing iron and steel production in Vietnam and illustrates the potential emissions reductions of CO2 through the use of green hydrogen as an alternative to coal.

Steel Production in Vietnam

As of 2021, Vietnam’s steel production capacity was 27 million tons per year, while hot-rolled steel is 7–8 million tons per year. According to the World Steel Association, Vietnam ranked twelfth among the top 50 largest steel-manufacturing countries globally in 2021, up from fourteenth place in 2019.[4] The steel sector accounted for around 6% of energy consumption in the country’s industrial sector.

Vietnam is using three steel production technologies: basic oxygen furnaces, electric arc furnaces, and induction furnaces. Carbon emission during steel production is complex and depends on various factors, such as energy sources, efficiency, and raw materials. Basic oxygen furnaces typically stand out as the most carbon-intensive due to their reliance on carbon-rich inputs like coke. Electric arc furnaces and induction furnaces, on the other hand, generally exhibit lower CO2 emissions. Electric arc furnaces benefit from the use of recycled steel, while induction furnaces are often more energy efficient. According to the Vietnam Steel Association, as of 2022, basic oxygen furnaces account for 49.2% of Vietnam’s production method, followed by electric arc furnaces (37.8%) and induction furnaces (13.0%).[5]

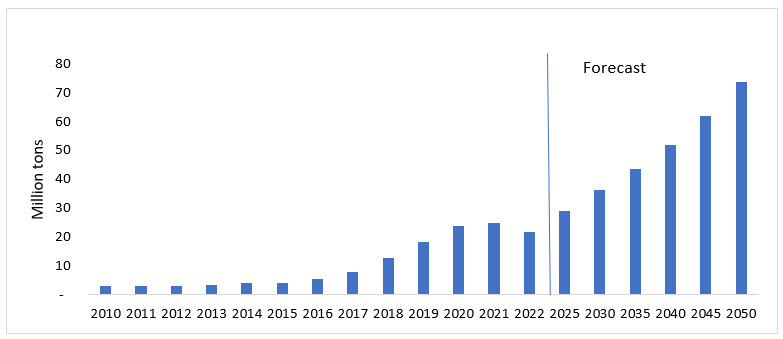

Domestic supply. Domestic iron and steel production increased significantly during 2012–22, from 3 million tons to 22 million tons, with an average growth rate of around 22% per year.[6] In the short and medium term, as living standards improve in Vietnam and other developing countries around the world, steel demand will increase. Domestic steel production in Vietnam is projected to increase from nearly 22 million tons in 2022 to 74 million tons in 2050, with a growth rate of around 4.5% per year (see Figure 1).

This projection is not for low-carbon steel, as the market for low-carbon steel technologies is not well-established. The recent policy shift toward the decarbonization of all sectors of the economy and emphasis on the use of climate-neutral industrial products could increase the demand for low-carbon steel in the future. However, steel demand has traditionally come from the infrastructure sector—i.e., construction, shipping, and power generators, all of which are hard-to-abate sectors, due to the relative dearth of low-carbon alternative production methods.

Figure 1: Iron and Steel Production in Vietnam by Year

Source: This forecast is based on the “Development Planning of Vietnam’s Steel Industry in the Period 2007–2015, with a Vision to 2025” and the “National Energy Master Plan for the period 2021–2030, Vision 2050.”

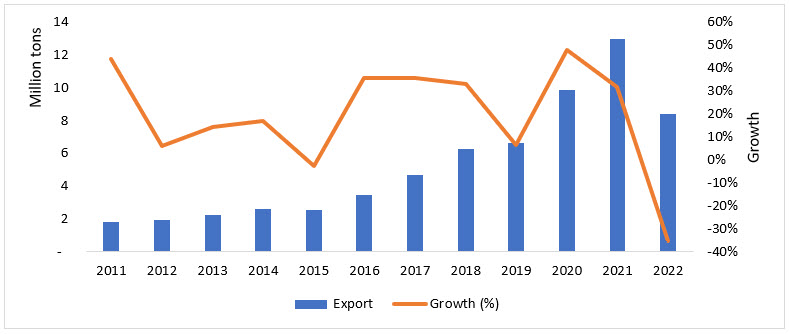

Exports. Vietnam’s steel exports increased from 1.3 million tons in 2010 to 13 million tons in 2021, with a growth rate of around 23% per year. In 2022, Vietnam exported around 8.4 million tons of steel, down 35.8% over the same period in 2021 because of inflation and an economic recession (see Figure 2). Export value reached $8 billion, down 32.2% over the same period in 2021. Vietnam’s main export markets are the ASEAN region (36.2%), the EU region (18.4%), the United States (10.6%), South Korea (6.8%), and Hong Kong (China) (4.1%).[7]

Emissions from iron and steel production in Vietnam. To estimate future emissions from iron and steel production in Vietnam, a study was conducted based on greenhouse gas inventory results in previous years and domestic steel production projections. Forecasts showed that CO2 emissions in the steel sector would increase from 40 million tons of CO2 equivalent in 2022 to nearly 140 million tons in 2050. This figure accounts for around 9% of domestic emissions and 11% of the domestic energy sector’s emissions in 2050.[8]

Figure 2: Vietnam’s Steel Exports by Year

Source: Vietnam’s Ministry of Industry and Trade, “Bao cao tinh hinh san xuat cong nghiep va hoạt dong thuong mại” [Report on Industrial Production and Commercial Activities], 2022, https://moit.gov.vn/thong-ke/bao-cao-tong-hop/phu-luc-bao-cao-tinh-hinh-san-xuat-cong-nghiep-va-hoat-dong-thuong-mai-thang-2-nam-2023.html.

The Potential of Hydrogen in Vietnam

Currently, gray hydrogen is predominantly produced and consumed by oil refineries and fertilizer plants, and only a small amount is used in the steel, glass, electronic, and food industries.[9] Oil refining, which is the sector with the highest demand for hydrogen, largely fulfills its own supply. Fertilizer production is the next largest source of gray hydrogen. Vietnam’s total gray hydrogen production capacity is just under 500,000 tons per year, represented by four fertilizer plants and two oil refineries.[10]

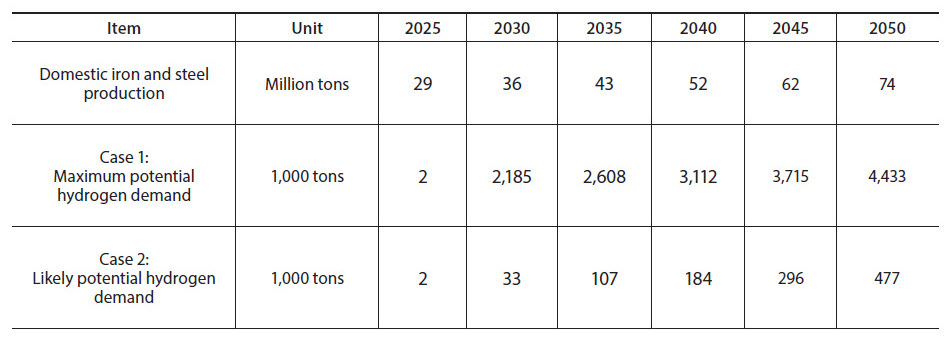

Based on domestic steel production and the amount of hydrogen required to create one ton of steel, we can estimate the potential use of hydrogen in steel production. It is shown that approximately 60 kilograms of hydrogen is required to produce one ton of steel.[11] Hydrogen demand is estimated in two cases. In the first case, demand is estimated by assuming that 100% of steel plants replace coal with hydrogen, and these results provide maximum potential hydrogen demand in the steel sector. In reality, this number should be seen as a theoretical ceiling to hydrogen demand, which will be lower in practice due to financial feasibility constraints. The second case is calculated by using the ratio of replacing coal with hydrogen in the iron and steel sectors, which is expected to be 4.3% in 2035 and 11% in 2050. This ratio is identified based on the following criteria:

- Location. Based on the iron and steel plant list, plants located in industrial parks will be prioritized.

- Enterprises. These enterprises export or tend to export products, especially to Europe.

- Time. Some plants will start replacing green coal with green hydrogen in 2035 (at the same time as the gas-fired power plants using domestic gas change to liquefied natural gas and hydrogen, which was mentioned in Vietnam’s Power Development Plan 8).

Given some of the above assumptions, hydrogen demand for the iron and steel sectors is shown in Table 1. In the first case, the potential reduction in CO2 emissions is nearly 140 million tons in 2050, whereas this figure would be only 15 million tons in the second case.

Table 1: Forecast of Hydrogen Demand for the Iron and Steel Sector

Options for Hydrogen Promotion in Vietnam

The climate impact of the iron and steel industries can be mitigated through increased energy efficiency in the manufacturing processes and increased utilization of lower-emission fuels. In addition, the use of better materials and the efficient use of end products would reduce the demand for iron and steel in the first place. Achieving ambitious greenhouse gas mitigation targets in these sectors will require an all-of-the-above approach. Besides improved performance, it is necessary to conduct fuel switching, and replacing coal with green hydrogen is a breakthrough technology that would be a game changer. However, the transition toward green hydrogen remains challenging.

To move forward, the Vietnamese government could consider the following policy options:

- Set more specific targets for overall hydrogen demand and supply, particularly focusing on consumption by the steel sector in the implementation plan. On February 7, 2024, Vietnam issued a national hydrogen development strategy, aiming to achieve a hydrogen production capacity of 100,000–500,000 tons per year by 2030. This target is expected to rise to 10–20 million tons per year by 2050, utilizing processes involving renewable energy and carbon capture and storage.

- Complete regulations, policies, and guidelines for domestic hydrogen development. First, the government could establish clear and consistent regulations for the production, transportation, storage, and use of hydrogen. Second, it could establish supportive policies and regulations that promote the integration of hydrogen technologies, including by providing incentives, setting targets, and implementing regulations to drive market demand for hydrogen and create a favorable investment environment for hydrogen projects. Finally, it could impose a carbon tax to regulate carbon pricing.[12]

- Encourage investment in pilot projects. While the price of steel is forecast to increase over time, the cost of hydrogen production is expected to fall when hydrogen is mass-produced. Replacing coal with hydrogen could be a promising option for decarbonizing the steel production process. Thus, the first pilot projects currently being set up will be critical to domestic hydrogen development.

- Develop training initiatives for energy company personnel, engineers, and technicians to enhance their skills and knowledge in hydrogen-related fields.

- Actively engage in international forums and collaborations to attract foreign investment in domestic hydrogen projects. In particular, Vietnam could participate in regional and global initiatives to exchange best practices, learn from successful cases, and leverage international funding opportunities.

In conclusion, hydrogen plays an important role in the energy transition, particularly within the steel industry—an energy-intensive sector that faces challenges in fuel replacement. For developing countries like Vietnam, hydrogen is forecast to emerge as a long-term solution. In the short and medium term, the country is expected to prioritize energy efficiency and renewable sources. Nevertheless, proactive research and preparation are necessary. In the maximum potential hydrogen scenario, the hydrogen demand for coal is estimated to reach 3.1 million tons by 2040, escalating to nearly 4.5 million tons by 2050. Correspondingly, in the likely potential hydrogen scenario, demand projections stand at 184,000 tons and 477,000 tons.

For Vietnam to accelerate the adoption of hydrogen in the steel industry, completing regulations and policies related to offshore wind development and hydrogen production is crucial. Additionally, initiatives such as investment in pilot projects, workforce development, and global knowledge exchange are essential measures to ensure a smooth transition away from coal in the steel sector.

Nghiem Thi Ngoan is an Energy Advisor at GIZ, Vietnam, where she is responsible for covering energy markets and policy in Vietnam and the Asia-Pacific area. She was a 2022–23 Clean EDGE Asia Fellow at the National Bureau of Asian Research.

Endnotes

[1] Timo Gerres et al., “Green Steel Production: How G7 Countries Can Help Change the Global Landscape,” Leadership Group for

Industry Transition, June 10, 2021, https://www.industrytransition.org/insights/g7-green-steel-production.

[2] “Gross Domestic Product by Expenditure Category at Current Prices,” General Statistics Office (Vietnam), 2022, https://www.gso.gov.vn/en/px-web/?pxid=E0308&theme=National%20Accounts%20and%20State%20budget.

[3] Le Anh Tu, “Nganh thep Viet Nam—kho khan trrong tinh hình moi” [Vietnam’s Steel Sector—Difficulties in a New Context], Vietnam Institute of Strategy and Policy for Industry and Trade, December 19, 2022, https://vioit.org.vn/vn/chien-luoc-chinhsach/nganh-thep-viet-nam—-kho-khan-trong-tinh-hinh-moi-5017.4050.html.

[4] “December 2021 Crude Steel Production and 2021 Global Crude Steel Production Totals,” World Steel Association, January 25, 2022, https://worldsteel.org/media-centre/press-releases/2022/december-2021-crude-steel-production-and-2021-global-totals.

[5]Pham Van Liem, “Tiet kiem nang luong va xu huong cong nghe trong nganh thep Viet Nam” [Energy Saving and Technology Trend in the Steel Sector], Vietnam Energy Conservation and Energy Efficiency Association, August 20, 2018, http://vecea.vn/tin-tuc/t353/tiet-kiem-nang-luong-va-xu-huong-cong-nghe-trong-nganh-thep-viet-nam.html.

[6] “Index of Industrial Production by Industrial Activity,” General Statistics Office (Vietnam), 2022, https://www.gso.gov.vn/en/px-web/?pxid=E0701&theme=Industry.

[7] “Tinh hinh thi truong thep Viet Nam thang 12/2022 va nam 2022” [Vietnam’s Steel Market December 2022], Vietnam Steel Association, 2023, http://vsa.com.vn/tinh-hinh-thi-truong-thep-viet-nam-thang-12-2022-va-nam-2022.

[8] Projections are based on the business-as-usual scenario in the Ministry of Natural Resources and Environment (Vietnam), “Technical Report for Vietnam Strategy on Climate Change,” 2022.

[9] Gray hydrogen is the most common and is produced using fossil fuels such as coal or natural gas without carbon capture and storage technology.

[10] Tran Khanh Viet Dung, “Overview of the Hydrogen Industry in Vietnam,” 2022.

[11] Abhinav Bhaskar et al., “Decarbonizing Primary Steel Production: Techno-economic Assessment of a Hydrogen Based Green Steel Production Plant in Norway,” Journal of Cleaner Production 350 (2022), 131339.

[12] To close the price gap between traditional and green steel, three main drivers will help tip the balance from coal to hydrogen in the steel industry: (1) increases in the price of carbon emissions, (2) the large-scale rollout of hydrogen production that will drive down the cost of electrolyzer facilities, and (3) cost reductions to the price of renewable electricity. It is estimated that, at a carbon emission price of over $75–$80 per ton of CO2, hydrogen would become the most economical option. See Christian Kurrer, “The Potential of Hydrogen for Decarbonising Steel Production,” European Parliamentary Research Service, December 2020, https://www.europarl.europa.eu/RegData/etudes/BRIE/2020/641552/ EPRS_BRI(2020)641552_EN.pdf.